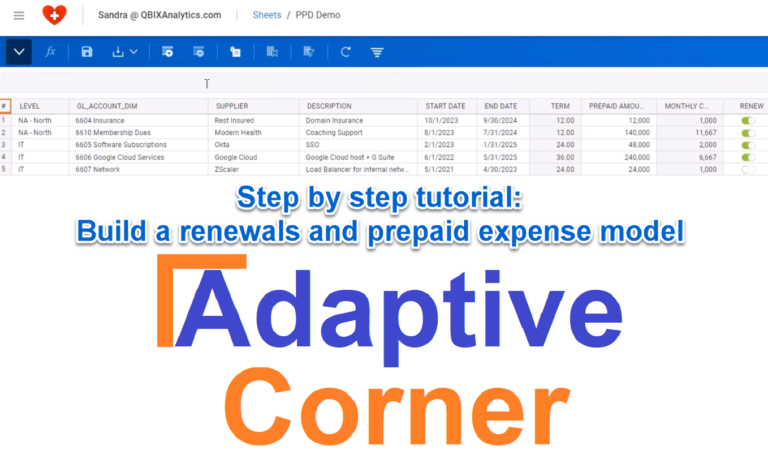

Adaptive Planning vs. Pigment

Today we focus on Adaptive Planning vs. Pigment. Financial planning technology can revolutionize the way you manage your organization’s fiscal data. However, it’s vital that you choose the right solution. It’s not just about managing numbers — it’s about finding…